Tools that expedite your search

Search and identify firms, companies, and executives

Build, manage and download lists of targeted M&A contacts with an intuitive user experience and advanced filtering & sorting tools.

Save searches and receive alerts

Get one-click access to your previous search history to view new transactions, executives, companies and firms, and receive automated weekly email notifications.

Exports

Download lists of contacts and firms to Excel to import into your CRM or download PDF firm profiles.

AI Search

Accelerate your M&A workflow with trustworthy artificial intelligence.

Data

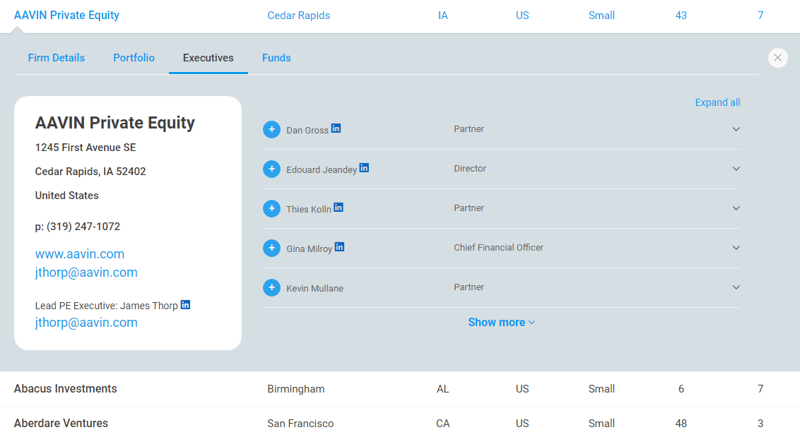

Firms

Executives

Companies

Funds

Exact Executive

Quickly identify the right private equity decision-maker for your deal.

Auto-Search

Save hours of research by instantly mapping the companies in an industry with just a few keywords.

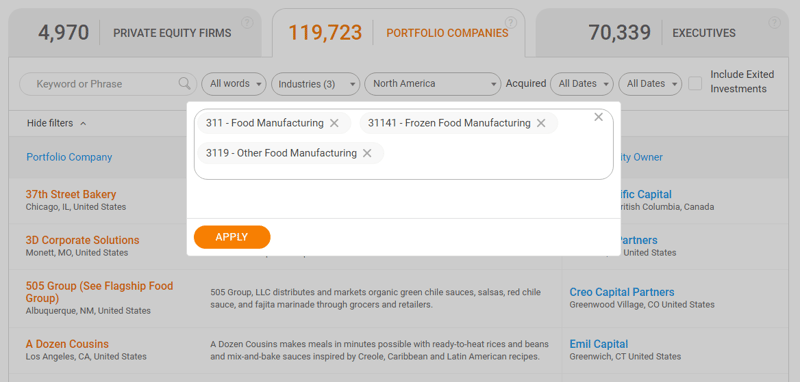

NAICS

Target companies quickly with standard industry code filters.

LinkedIn Profiles

Connect to key executives through LinkedIn.

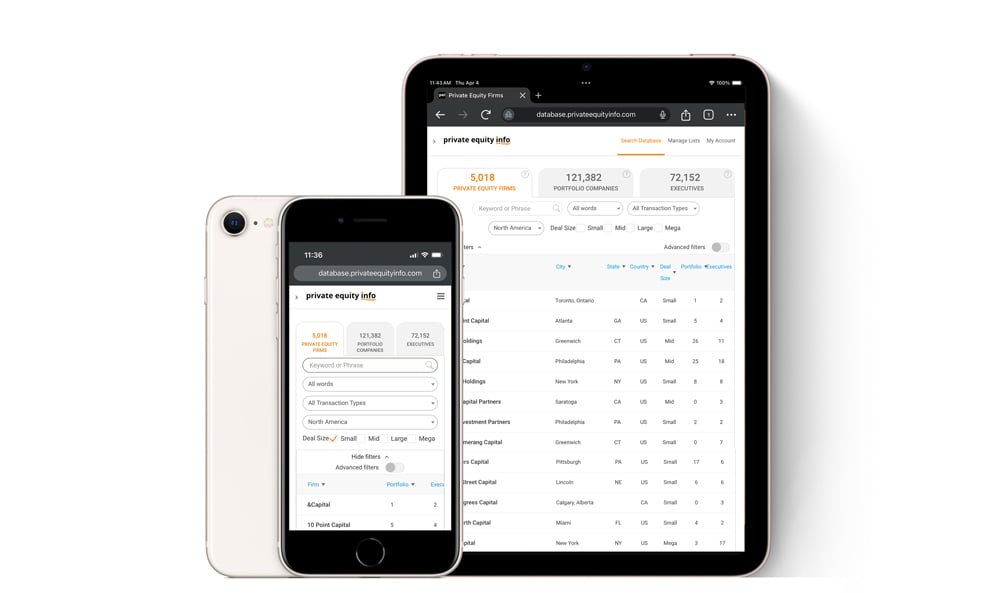

Desktop & Mobile Experience

Use Private Equity Info on any device.

.png?width=239&height=239&name=McCormack%20-%20PEI%20Case%20Study%20Headshot%20Card%20(1).png)