Tools that expedite your search

Platform Features

Target the companies, firms, key executives and transactions that are driving mergers & acquisitions and shaping industries. Learn about our intuitive M&A research database and watch demo videos of our time-saving tools.

Search and identify firms, companies, and executives

Build, manage and download lists of targeted M&A contacts with an intuitive user experience.

Save searches and receive alerts

Get one-click access to your previous search history to view new transactions, executives, companies and firms, and receive automated weekly email notifications.

Export contacts

Download your lists to Excel and easily upload to any CRM.

Exact Executive

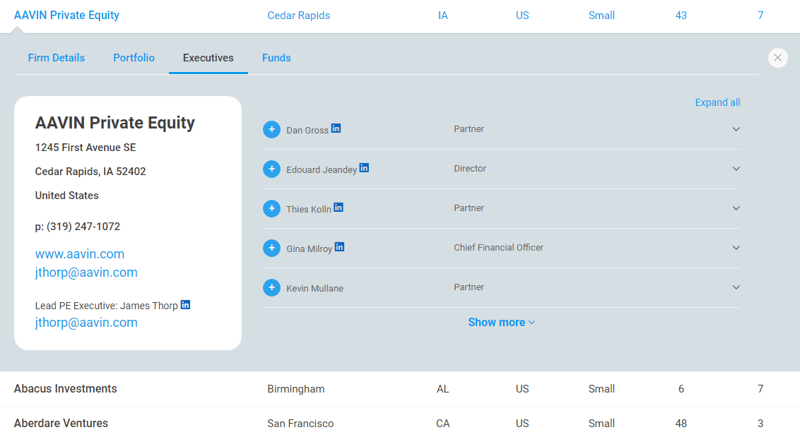

Quickly identify the right private equity decision-maker for your deal.

Data

Firms

Executives

Companies

Funds

Auto-Search

Save hours of research by instantly mapping the companies in an industry with just a few keywords.

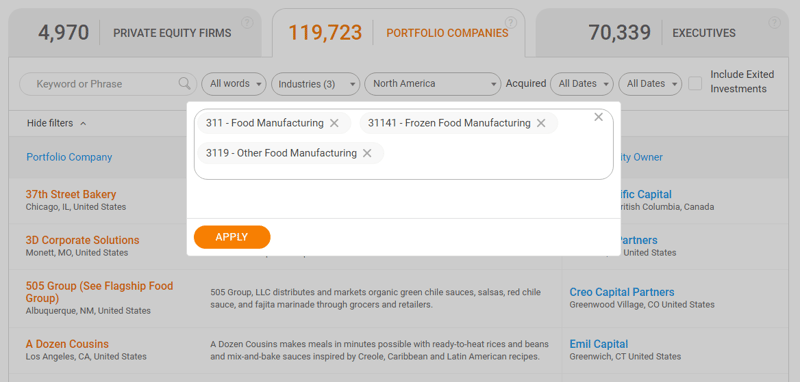

NAICS

Target companies quickly with standard industry code filters.

LinkedIn Profiles

Connect to key executives through LinkedIn.

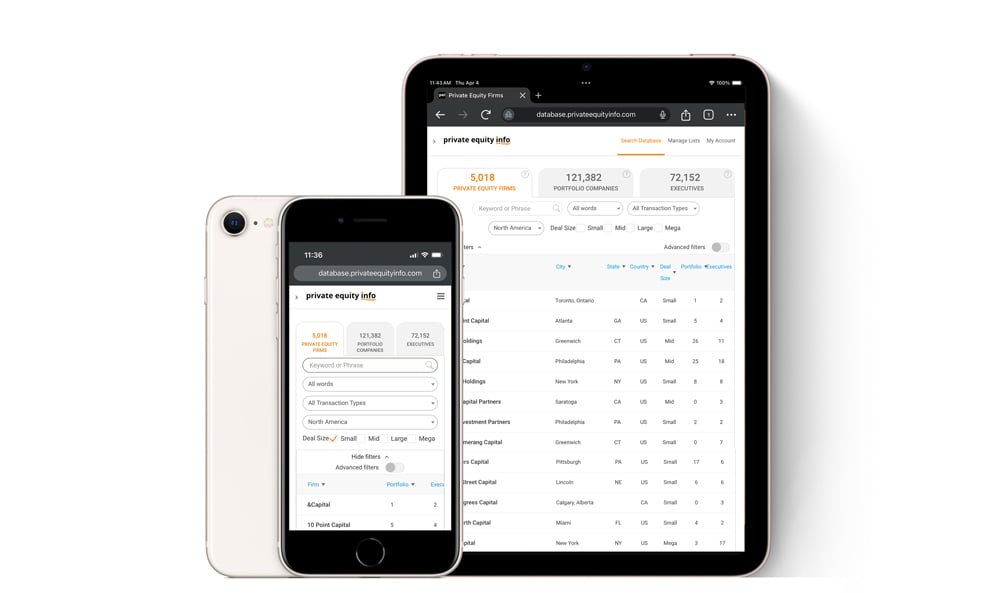

Desktop & Mobile Experience

Use Private Equity Info on any device.

Testimonials

Learn why M&A professionals love our easy-to-use interface.

"This is really an excellent tool and very user friendly. The search tools provided exactly the kind of simple user interface that we needed to find qualified buyers for our clients. "

Stephanie

"We really like the Auto-Search tool. We see the value in the results and it saves us a lot of research time."